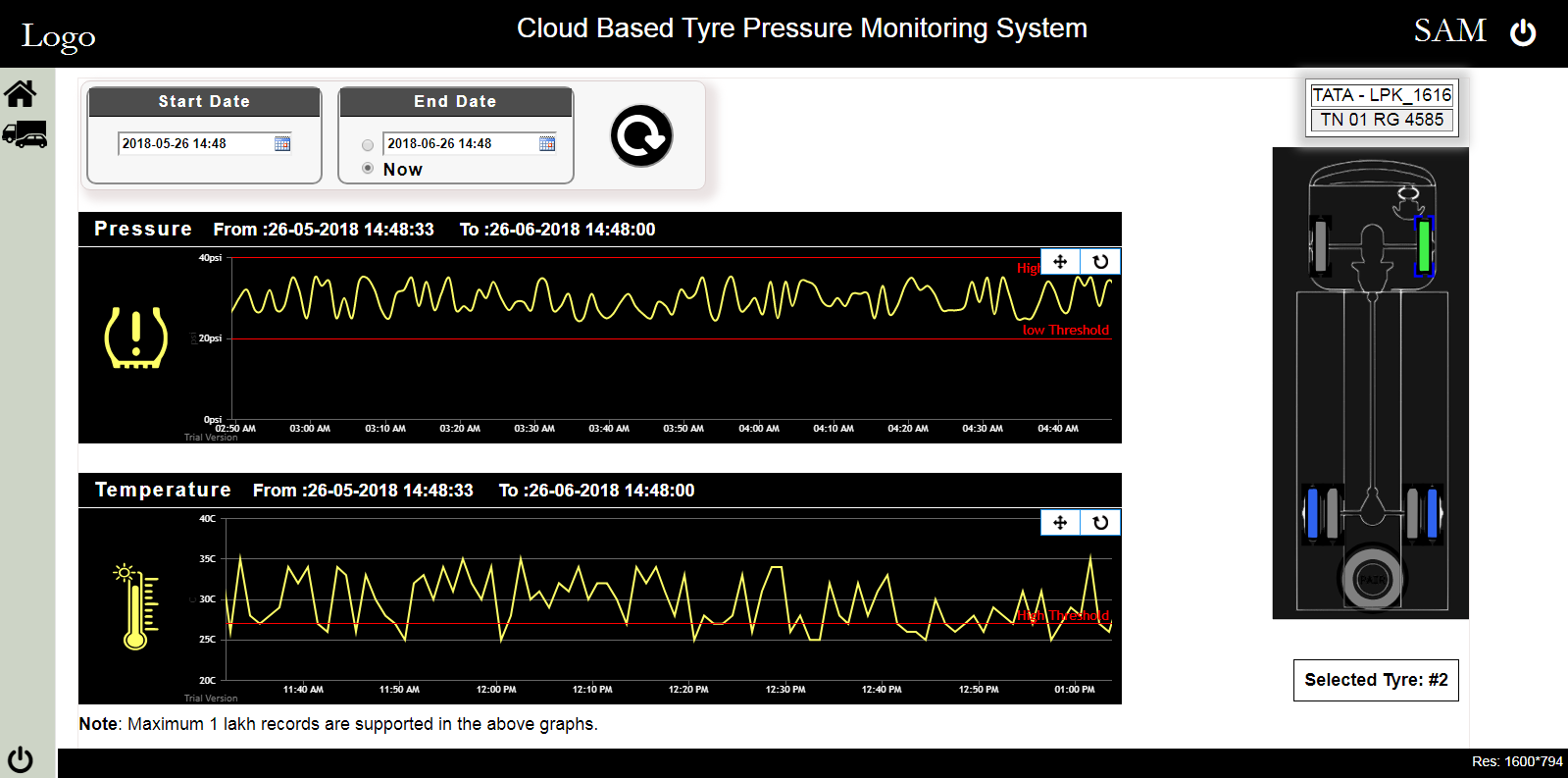

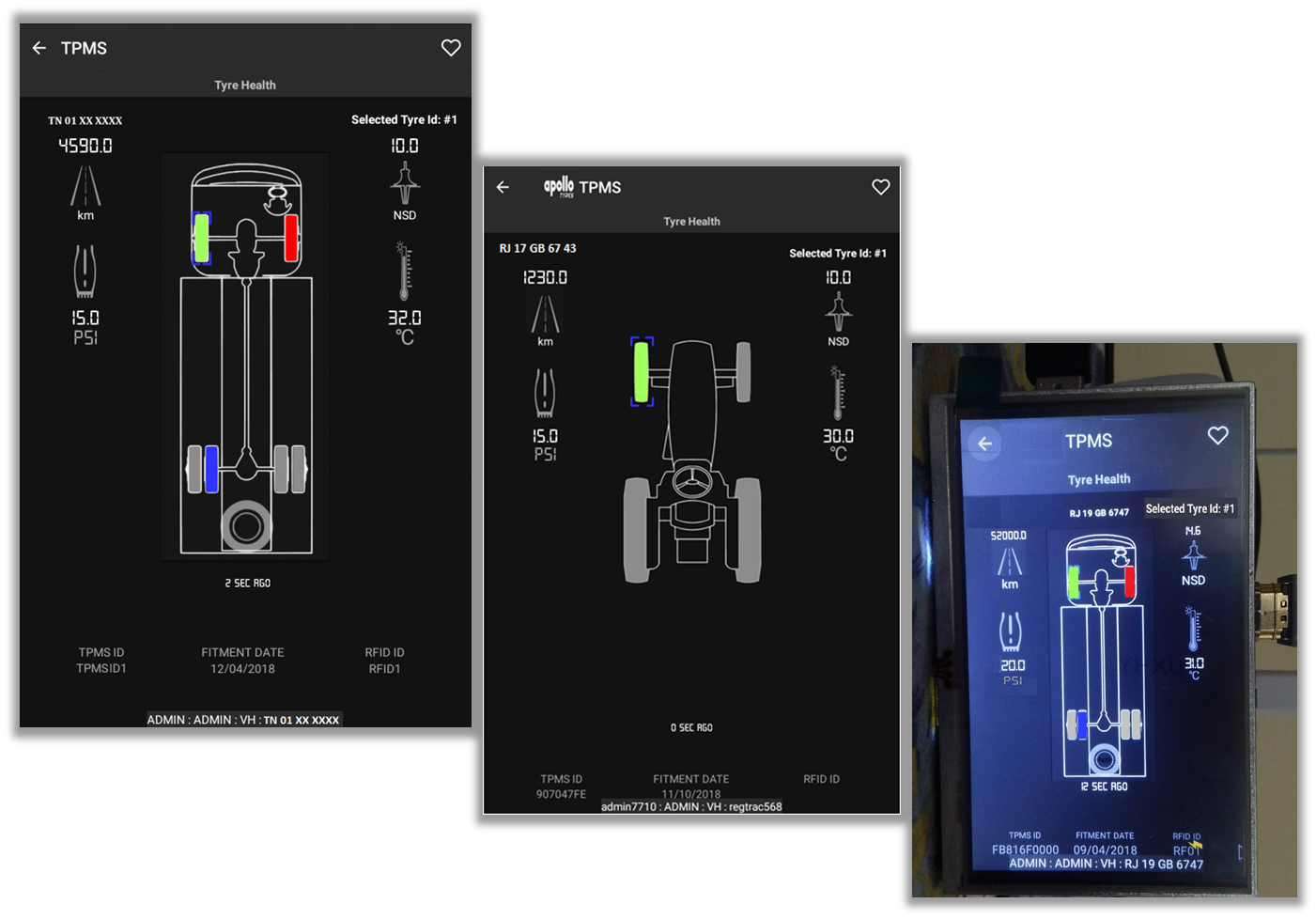

We had already developed a Tyre Pressure Monitoring System(TPMS) Android Application for a leading global tyre manufacturer.

The Android App communicates via bluetooth with the sensors mounted on the vehicle’s tyres and displays the pressure and temperature of each tyre on the Android device. …

Tyre Pressure Monitoring System

Tyre Pressure Monitoring System (TPMS) – Mobile Application and dashboard mountable module for a global tyre manufacturing company.

TPMS is an electronic system designed to monitor the air pressure inside the pneumatic tyres on various types of vehicles. TPMS provides real-time tyre-pressure information (and optionally, temperature) to the driver of the vehicle, either via a gauge, a graphic display, a simple low-pressure light or even a Smartphone Application. …

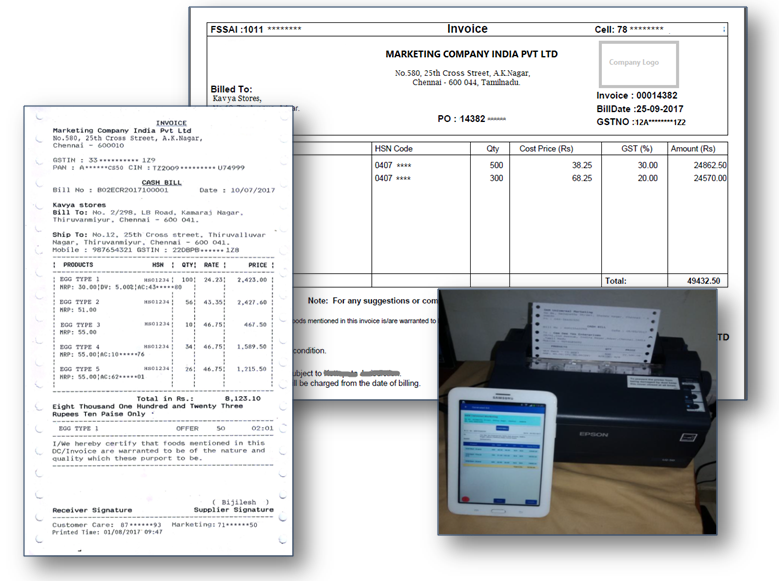

12V DC Printer with Wireless Connectivity

We are happy to introduce a new feature in our “Delivery Management System” to generate invoices / receipts and print them on the spot.

Print the Bills/ Receipts from our mobile application via modern Bluetooth wireless communication technology on the go. …

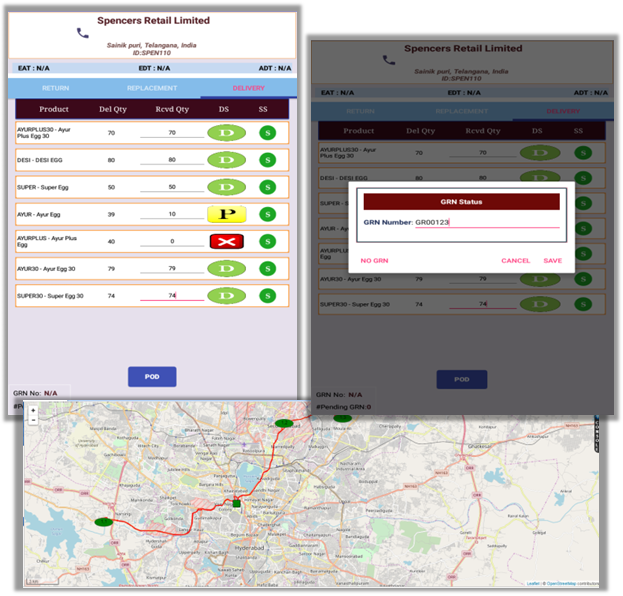

Electronic Proof of Delivery

Electronic proof of delivery (ePOD) helps companies to achieve faster, more efficient deliveries with significantly less paperwork and reduced manual data entry.

A Proof of Delivery or POD is a receipt which establishes the receiver’s acknowledgement of the freight received in a good condition. POD contains information relayed by the carrier, …

Account Receivable Ageing Summary

Financial Control is an important aspect of running any business. Managing the “Account Receivable” is one of the key tasks of managing the working capital. “Account Receivable – Ageing Summary Report” helps our customer to visualize pending payments from their customers.

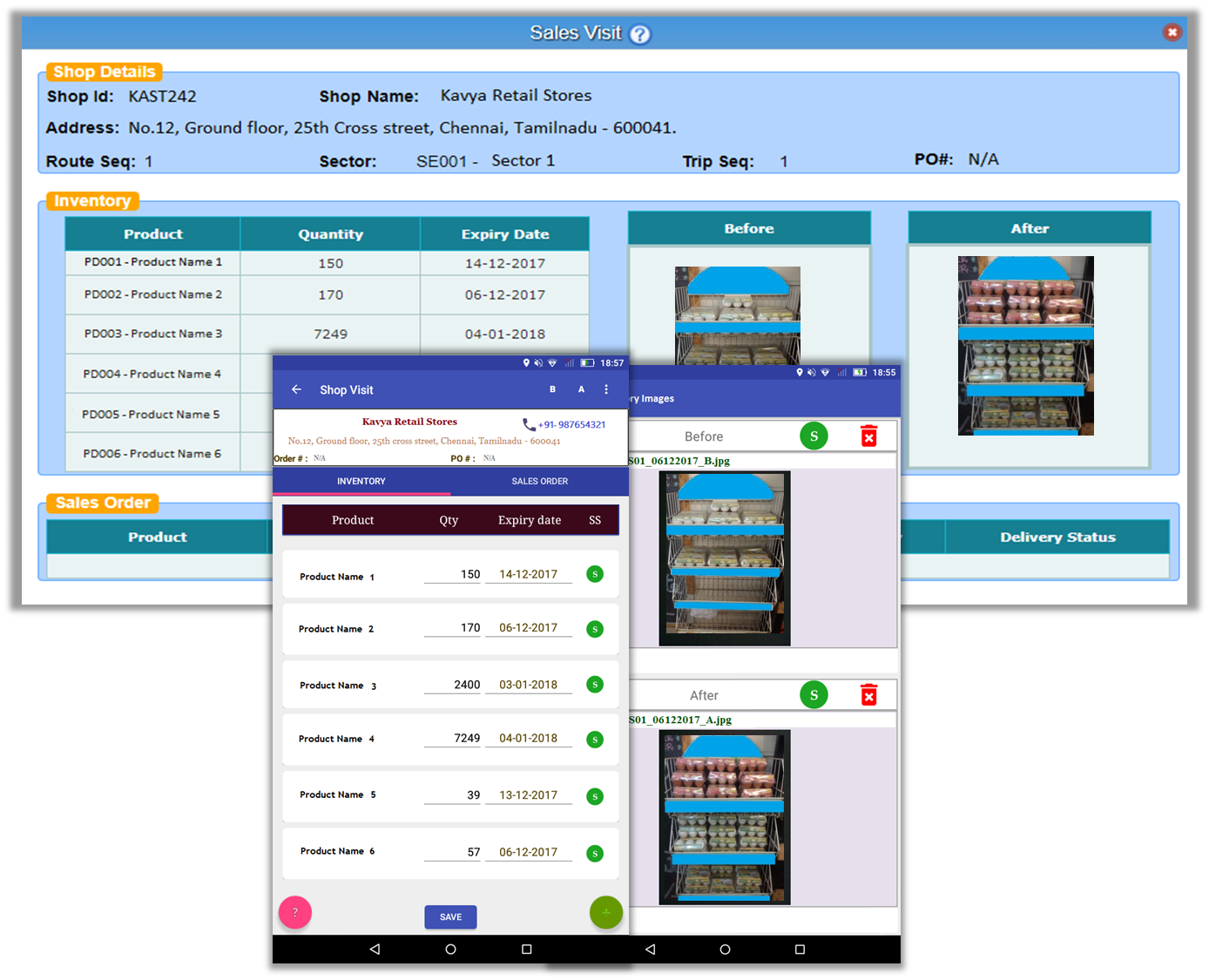

Shop level Inventory Accounting & Management

Irrespective of the size, stores should be inventoried on regular basis. Unless it is visualized, you may not have an idea of the stock of your products in the particular store and their positioning within the store and the shelves.

Our SDMS android app helps your field sales executive to capture the inventory details, which is supported by the photographs. Not only Back office team has the exact status of inventories in shops visited by field sales executives, but they also can see the inventory positioning from the captured photographs.

Such a feature helps with: …

Mobile App based sales lead capture

Let’s start with the basics. A lead is a person who has indicated interest in your company’s product or service in some way.

To grow any business, “Quality lead generation” is an important activity, especially for a start-up companies. There are many ways to generate a lead. Some of them are: …

Track Deliveries in Real time

Are you facing difficulty to track and analyse delivery and its location in your business?

Are you stuck to find whether the item is delivered to correct location of the customer or not ?

How to find the current location of Delivery man?

How to get the geo-location of completed deliveries? …

On-Spot Bill & Receipt Printing

Print the bill and receipt at the shop itself after the delivery is made.

Cut-down 3 Day Process to Zero

Currently, when delivery is made to the customer, delivery boy captures the delivery details in pre-formatted delivery sheet. Then delivery boy submits the ‘delivery details’ in the Warehouse. …

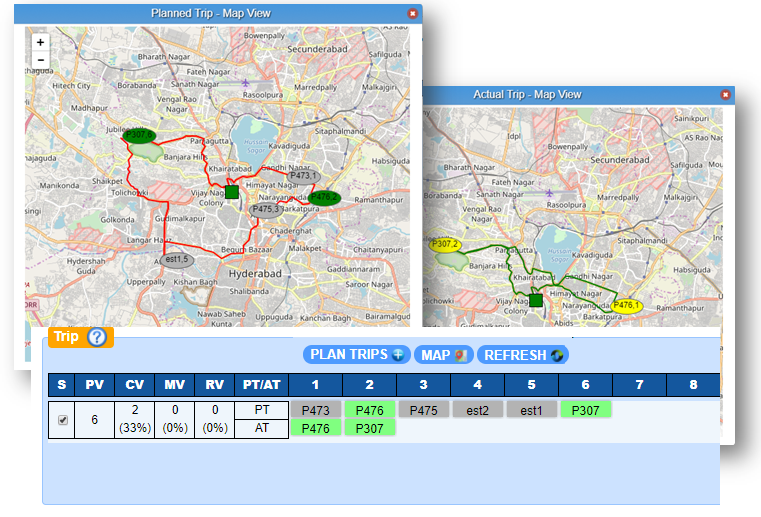

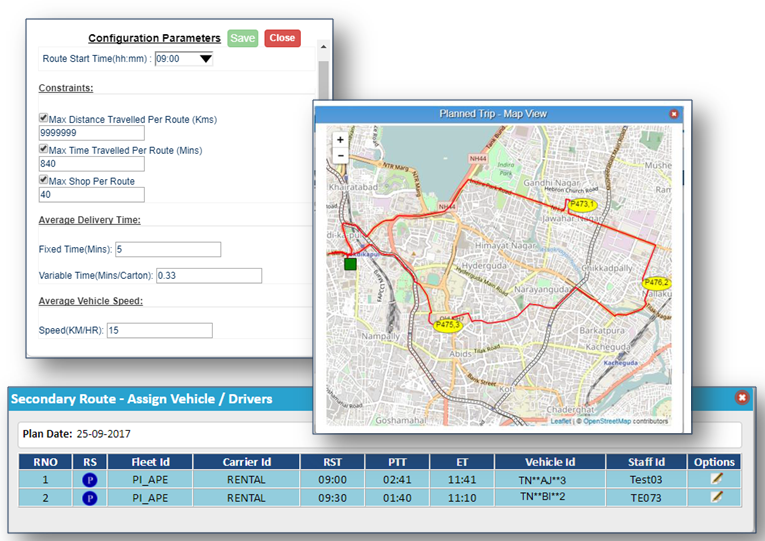

Optimal Sales executive routes and delivery routes Generation

Is your Clock running faster than planning the routes for your sales executives and delivery boys. Don’t worry, Our SDMS system plans and generates optimal routes for your sales and delivery teams in a minute.

Routes are generated dynamically based on various factors

- Shortest route

- Capacity utilization of truck

- Different fleet types

- Carrier of the vehicle

- and more.